CSRD: Transformations in extra-financial reporting unveiled

Explore the profound shifts in extra-financial reporting brought about by the CSRD directive. Learn about verification processes, compliance steps, and the pivotal role of double-materiality analysis for sustainable business practices.

Who is affected by the CSRD, and from when?

The obligation for non-financial reporting is not new: under the NFRD, 11,700 companies in Europe were already required to publish an extra-financial performance statement. This applied to all major publicly listed companies and some large privately held companies with revenues or balance sheets exceeding €100 million.

However, the CSRD extends the obligation to a considerable number of companies: approximately 50,000 will be subject to sustainability reporting. This will gradually include all listed companies, regardless of size, as well as all large European companies, whether listed or not. Non-European companies meeting certain size criteria are also included in the scope of the directive.

Here are the details of the thresholds and effective dates of the CSRD sustainability reporting obligations:

🗓️ Declarations in 2025, regarding the 2024 financial year: All companies already subject to the NFRD, i.e.,

- Listed companies with over 500 employees and revenues exceeding €40 million or a balance sheet exceeding €20 million.

- Non-listed companies with over 500 employees whose revenues or balance sheets exceed €100 million.

🗓️ Declarations in 2026, regarding the 2025 financial year:

- All other European companies (listed or not) meeting two of the following three criteria: over 250 employees, more than €25 million in balance sheet total, and more than €50 million in revenue.

- All non-European companies listed on a EU market meeting the above two out of three criteria.

🗓️ Declarations in 2027, regarding the 2026 financial year (with a possibility of a 2-year extension if stated in the management report): All European or non-European SMEs listed on a EU regulated market, excluding micro-enterprises. This includes any company exceeding two of the following thresholds: 10 employees, €250,000 balance sheet total, and €700,000 in revenue.

🗓️ Declarations in 2028, regarding the 2027 financial year: Non-European companies generating over €150 million in revenue in the EU and having a subsidiary or branch based in the EU.

It's worth noting that on October 17, 2023, the European Commission adopted an amendment changing the definition of a large enterprise by raising the corresponding revenue and balance sheet thresholds (€50 million in revenue instead of €40 million and €25 million in balance sheet total instead of €20 million). We have taken this into account in this article.

The CSRD directive requires the text to be transposed into the national law of member states no later than July 6, 2024. France was the first country to do so through a decree on December 7, 2023.

Specific standards for SME declarations and additional sector-specific standards will still need to be defined (by June 2026).

What information must be disclosed in the sustainability report?

Information Required by the CSRD

The major difference introduced by the CSRD, significantly elevating the level of requirements, is that sustainability reporting is now standardized. Information must be published in the management report according to a specific structure and format established by the ESRS standards.

The ESRS standards were developed by EFRAG, in line with CSRD requirements, and adopted on July 31, 2023, through a delegated act (see the press release from the European Commission on this matter).

Another significant novelty introduced by the CSRD is the concept of double-materiality. Only information deemed "material" for the company after its double-materiality analysis must be published.

So, two key points:

- standardized information

- publication conditioned on a double-materiality analysis

We delve into each of these points in the rest of the article.

Here are the categories of information that companies must publish in their management report to meet CSRD requirements:

- Business model and strategy (including resilience, compatibility with the Paris Agreement, integration of stakeholder interests, and sustainability)

- Sustainability objectives, including greenhouse gas emissions, and policies pursued to achieve them

- Competence of administrative, management, and supervisory bodies regarding sustainability issues

- Sustainability-related incentive systems for members of these bodies

- Descriptions of

- the due diligence procedure implemented regarding sustainability issues, in accordance with the due diligence directive (CSDD)

- the negative impacts of its activities and those of its value chain (supply chain, products and services, business relationships) on the environment and stakeholders

- measures taken to prevent, mitigate, or eliminate these impacts and the results achieved

- Description of sustainability-related risks for the company and how it manages them

- Description of the method used to obtain the reported information.

It's worth noting that the information to be published is simplified for SMEs and includes:

- a brief description of the company's business model and strategy;

- a description of the company's policies regarding sustainability issues;

- the main actual or potential negative impacts of the company on sustainability issues, and any measures taken to identify, monitor, prevent, mitigate, or rectify them;

- the main risks for the company related to sustainability issues and how the company manages these risks;

- key indicators necessary for the information to be published as outlined in points a) to d).

CSRD mandates that specific standards for SMEs be adopted through a delegated act before June 2024.

If information regarding its value chain is not entirely available, the company must present the efforts made to obtain it, explain why it could not be obtained, and outline the approach in place to obtain it in the future.

Different Types of ESRS Standards Established by the CSRD

The CSRD envisages the creation of detailed standards to regulate and harmonize company reporting: the "ESRS" standards (European Sustainability Reporting Standards).

The European Commission has commissioned EFRAG to develop three categories of ESRS standards:

- "Universal" standards, applicable to all sectors of activity. These standards were adopted in July 2023.

- Sectoral standards, which, as the name suggests, will apply to specific sectors. Their adoption, initially scheduled for June 2024, has been postponed to June 2026.

- Specific standards for listed SMEs, which must be adopted by delegated act by June 2024.

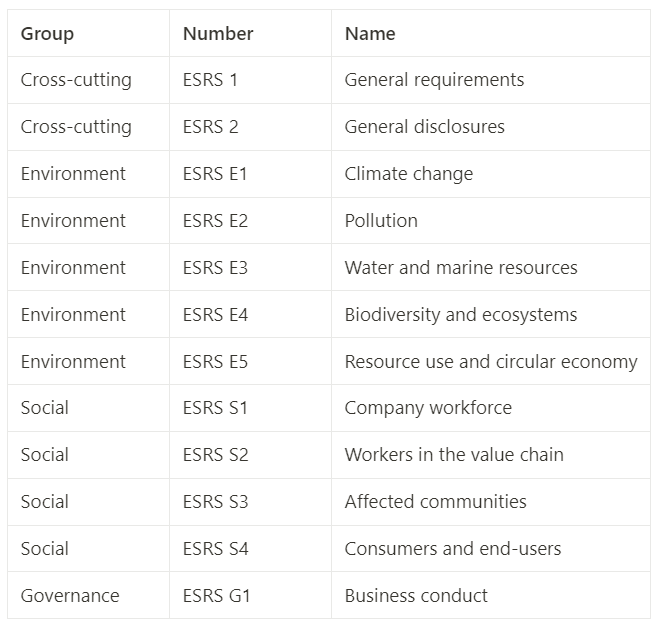

The 12 Universal ESRS Standards

Among the universal standards, the only ones adopted to date include two cross-cutting standards, five concerning the environment, four concerning social aspects, and 1 concerning governance.

Each standard is a document detailing, on a given subject, what content and data are expected in the sustainability report. The information to be displayed is both qualitative and quantitative and includes:

- integration of CSR issues into the company's governance and development strategy

- the company's management of impacts, risks, and opportunities related to CSR

- monitoring of indicators and the company's objectives

Here is the list of the 12 universal ESRS standards:

The ESRS standards have been designed as management tools for the company to facilitate its transition to a sustainable business model.

Each standard requires the publication of certain indicators, elements related to the company's strategy, risk management system, and impacts, as well as its objectives. Each standard is divided into sub-themes, each with several disclosure requirements, which themselves consist of several data points.

Let's take the example of the climate standard (ESRS E1). Companies covered by the CSRD must include (among other things) in their management report:

- their transition plan to mitigate climate change (with specific required objectives, for example, on reducing greenhouse gas emissions)

- an analysis of risks to their business related to climate change and the impact of their activities on climate change

- information on the resilience of their model to climate change

- their energy consumption and energy mix

- their scope 1, 2, and 3 greenhouse gas emissions

Find the ESRS standards, along with explanatory videos for each, on this page.

EFRAG has also published implementation support documents, including the Excel format list of data points required by each ESRS standard.

ESRS Standards to Report On

Only ESRS 1 and ESRS 2 standards are mandatory. For all others, the company is subject to reporting obligations only if the associated issue is deemed "material" following a double-materiality analysis (we explain this concept in the next paragraph).

However, if a company decides not to report on ESRS E1 (Climate), it must justify this decision by precisely presenting the analysis method that led to the conclusion that climate is not "material" to its business.

In practice, any activity impacting or impacted by climate change can be considered as requiring the inclusion of ESRS E1 in the management report.

Then, within each standard, it is up to the company to assess materiality for each sub-theme and indicator in relation to its business.

The Concept of Double-Materiality

The concept of double-materiality is crucial for the implementation of the CSRD by companies.

Double-materiality indicates a reciprocal interaction between a company's activity and society and the environment:

- the company's activity has an impact on society and the environment: this is referred to as impact materiality

- social, environmental, and governance issues can themselves have an impact (positive or negative) on the company's economic performance: this is referred to as financial materiality

The existence of financial materiality explains why the term "non-financial information" is no longer used to refer to ESG information, but rather "sustainability information." "Non-financial" is misleading as it suggests that ESG issues are not correlated with the economic performance of the company.

Companies subject to the CSRD must conduct a double-materiality analysis on each theme, sub-theme, indicator, and data point in the ESRS standards. This is how they determine the content to include in their sustainability report. This analysis must be done in collaboration with the company's stakeholders.

EFRAG has drafted a methodological guide to assist companies in conducting their double-materiality analysis.

How is CSRD Information Verified?

The sustainability report published by companies must be verified by an accredited independent third-party organization, which will conduct an audit of the information and assign it a level of assurance. The goal is to achieve a "moderate" level of assurance initially, progressing to a "reasonable" level from 2028.

How to Achieve Compliance with CSRD?

To comply with CSRD, a company must first conduct a double-materiality analysis to identify the sustainability information it needs to publish.

Next, it should perform a gap analysis to identify the information it already possesses and what is missing.

The company then gathers the missing information, incorporating it into the management report in the format required by the ESRS standards. The report must be available in XHTML electronic information format for submission to ESAP.

We emphasize the importance of promptly implementing processes for each of the steps described above and the opportunity to rely on guides published by EFRAG and ANC.

CSRD is complemented by other regulations that require supply chain data collection. To learn more, read our article about the European Textile Strategy.

Non-financial reporting, now commonly referred to as ESG reporting or sustainability reporting, is a cornerstone of companies' CSR transformation. It involves communicating information related to the environmental, social, and societal impacts of their activities, as well as their governance, to stakeholders such as investors, citizens, civil society, and the state.

Sustainability reporting provides stakeholders with a holistic view of the company's activities and its ability to sustain a healthy business in the long term. Importantly, it enables the company to better steer its strategy.

The obligation to disclose non-financial information has been regulated by law since the European directive NFRD (Non-Financial Reporting Directive) of 2014.

With the CSRD (Corporate Sustainability Reporting Directive) enacted in 2022, the European Union has decided to expand and strengthen the provisions of the NFRD.

Notable changes introduced by the CSRD include a significantly expanded scope, standardized content and format for sustainability information (governed by ESRS standards), and a requirement for third-party verification of the information.

→ Who will be affected by the CSRD, and from when?

→ What information will need to be included in the sustainability report?

→ What will be the methods for displaying sustainability information?

In this article, discover the key information to know about the European CSRD directive.

white paper

replay

Summary

Fill out the form below.

.avif)